In my last few energy posts (link 1, link 2) I've written about Saskatchewan's plan to transform our electrical supply away from coal and towards gas and renewables, both from an instantaneous generation (MW) standpoint, and total power delivered (GWh) standpoint.

Where does the gas come from? What are some of the unique risks associated with gas? How does the Alberta oil & gas industry affect our utility bills?

To learn more I read through SaskEnergy's 2021-22 (and 20-21) annual reports, located here. All page numbers mentioned below reference the 2021-22 report's numbered pages (not the PDF page numbers) unless otherwise indicated.

This post will cover:

- What is SaskEnergy?

- Visualizing Saskatchewan's natural gas usage

- Factors contributing to the recent 22.7% rate hike

Read on...

What is SaskEnergy?

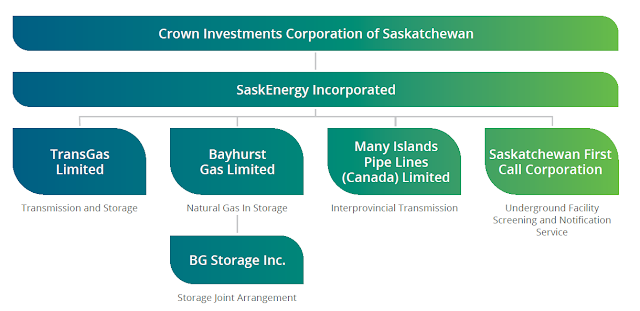

SaskEnergy (Incorporated) is one of seven Crown Corporations owned by Crown Investment Corporation of Saskatchewan, which is the intermediary between the Crown Corps and the Saskatchewan Legislative Assembly.

|

| From p5 |

SaskEnergy is responsible for distributing natural gas, e.g. metering it out to homes, businesses, and large industrial customers. SaskEnergy has the "exclusive legislative franchise to distribute natural gas within the province of Saskatchewan." It also has four subsidiaries: TransGas (transmission and storage: the roots, trunk, and big branches, whereas SaskEnergy is the small branches and leaves), Bayhurst (a small gas producer), MIPL (interprovincial/state interconnections), and Call Before You Dig.

Saskatchewan uses a lot of gas.

Here are some stats from page 17 of the 2021-22 report with embellishments by yours truly.

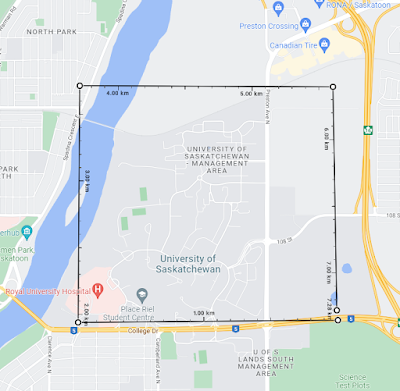

In the 2021-22 reporting year, SaskEnergy sold 6,329,000,000 cubic metres of natural gas. A cube with that volume would have edges 1.85km long. This cube would cover the entire University of Saskatchewan campus and a good chunk of the nearby fields and river, including the whole train bridge. The gas cube would be approximately 1,760 metres taller than Nutrien Tower, the tallest office building in the province (at 88 metres).

(Photoshop request: Saskatoon skyline with a 2km³ gas cube in the background)

The average residential gas customer in SK used 2,677 cubic metres of natural gas in 2021-22, which is just over the volume of an Olympic swimming pool (2,500 cubic metres).

|

| Image source |

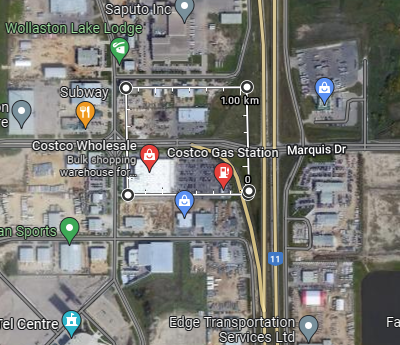

The peak daily flow of gas in Saskatchewan was 1.65 petajoules on January 5, 2022, equivalent to about 44,000,000 cubic metres of gas. If you turned this volume into a perfect cube, it would be about 350 metres on each side, which is about 2.5 Costco stores (North Saskatoon location).

Why is SaskEnergy is hiking rates by up to 22.7% over the next two years?

A multi-year rate hike was announced a few weeks ago. For many, this is a hard pill to swallow given concurrent SaskPower rate increases (covered in my last post), inflation, and everything else going on in the world.

To understand the SaskEnergy rate hike - and the future of natural gas in Saskatchewan - we need to dive into a couple areas:

- How Crown Corporations work

- Where gas comes from

- Risks to SaskEnergy

How Crown Corporations Work (at least in Saskatchewan)

SaskEnergy, like other provincial Crown Corporations, is a subsidiary of Crown Investments Corporation (CIC). CIC is wholly owned by the Province of Saskatchewan: the Crown (province) is the sole shareholder of CIC.

Wikipedia says, "Some Crown corporations are expected to be profitable organisations, while others are non-commercial and rely entirely on public funds to operate". CIC is expected to be more on the profitable side. On p14 of CIC's 2021-22 Annual Report, they state (emphasis mine):

CIC is focused on providing a reasonable return to the Province. This priority must be balanced with its public policy initiatives, reinvestment in sustaining infrastructure, and providing high quality public services for the lowest possible cost.

Dividends from Crown Corporations go into the Province of Saskatchewan's General Revenue Fund (GRF). CIC targets a specific rate-of-return that balances costs, public access, and a target rate of return which is set to pay for public programs and reinvest in the Crown Corps for future growth and sustainability.

As a regulated utility, SaskEnergy is required to "not earn a profit or realize losses on the sale of gas to customers over the long term" (p32, SaskEnergy report). Furthermore, SaskEnergy can only adjust rates when approved by the Saskatchewan Rate Review Panel (SRRP). Rates have been frozen a while due to COVID.

When natural gas prices go up or down, SaskEnergy can't immediately pass those costs (or savings) on to customers. Differences are captured in what they call the Gas Cost Variance Account or GCVA (p32). They are charged (or refunded) to customers as part of future rate adjustments.

On March 31, 2021, the GCVA balance was $6 million owing from customers due to increasing commodity costs. One year later on March 31, 2022, now the GVCA balance was $15 million owing from customers, "a result of the AECO [Alberta Energy Company] daily index increasing commodity purchase costs" (p33) or in plainer English, gas being more expensive.

(I looked back one more year: the 2019-20 report says the GCVA owed customers $13 million)

So, the rate increase is partially to cover this balance in the GVCA, but also to cover expected rising costs (keep reading).

Where does Saskatchewan get natural gas?

The short answer is: we used to make it here, but now we buy it from Alberta.

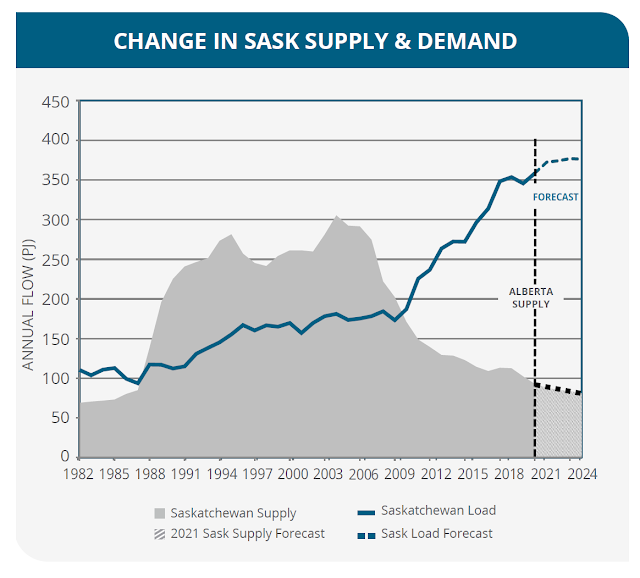

From 1988 through 2009, Saskatchewan was a net exporter of natural gas (see chart below). During this time of plenty, the gas demand curve increased quite gradually. In the mid-2000s, our production started to plummet and in 2009 - the inflection point of being a net exporter vs. a net importer - demand started to skyrocket. The difference between the blue line and the gray blob is the gas we import from Alberta. Today Alberta supplies about 75% of natural gas used in Saskatchewan.

|

| p30, 2021-22 Report |

This increasing demand can be at least partially attributed to new natural gas generating stations coming online in the late 2000s and early 2010s (link), plus major industrial expansions (potash went crazy in the late 2000s and early 2010s; every site in the province expanded and new sites came online), plus other growth factors that are opaque to me.

Production of natural gas in Saskatchewan is "more than 70% associated" with oil production according to SaskEnergy's 2020-21 report (p27), meaning natural gas is a byproduct of oil refining. SaskEnergy adds, "local [SK] supply [is] highly dependent on the volatile global oil market." In comparison, Alberta has fields which produce natural gas directly (source 1, source 2).

Now, here's a scary idea. Saskatchewan and Alberta are reasonably (but not completely) decoupled and sheltered from global energy markets, but that may change in the very near future (emphasis mine):

Europe is facing an energy shortfall and increasing natural gas prices. Energy demands there may be met, in part, with increased shipments of liquified natural gas (LNG). Canada is still expected to enter the LNG export market when the LNG Canada export facility near Kitimat, British Columbia opens in several years. A smaller project near Squamish has also made progress with the final investment decision expected later in 2022.

Despite finite LNG export capacity keeping North America somewhat isolated from high global energy prices, growing export capacity and the uncertainty around the duration of Europe’s energy shortfall kept upward pressure on North American prices through the end of the fiscal year. (p30)

The United States are ramping up LNG exports to Europe amid the EU's current energy crisis.

What this means for SK: the more coupled our energy supply is to the rest of the world, the more volatility Saskatchewan ratepayers will be exposed to, and the higher our energy bills will be.

A simple way to grasp this is to think about this question: Will Sask natural gas prices go up or down if Alberta gains the ability to sell LNG to thirsty international markets?

An Aside: Humans Are Bad At Predictions

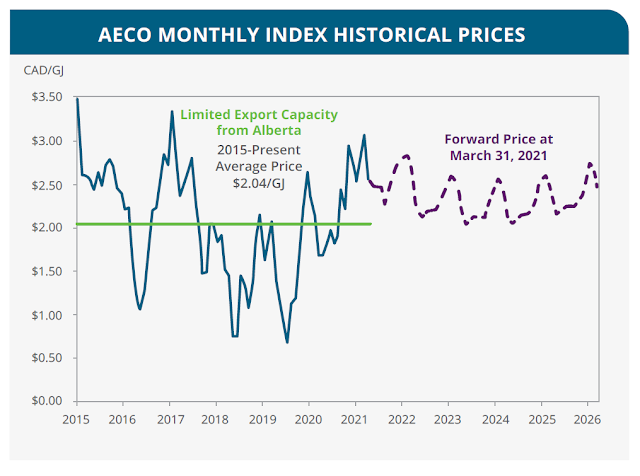

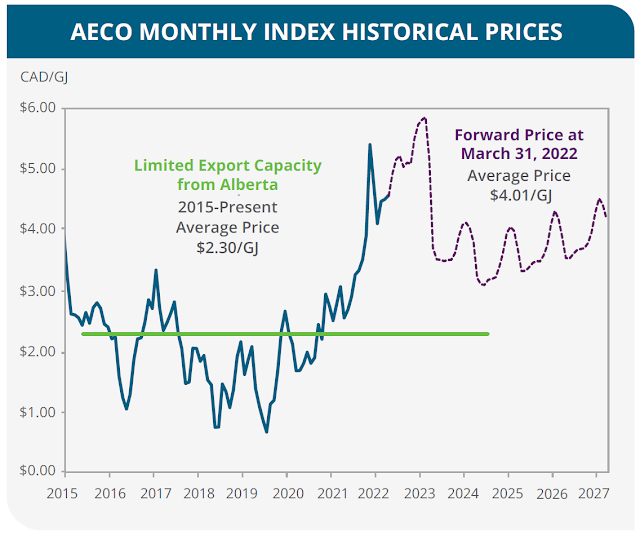

I wanted to highlight the differences between SaskEnergy's future natural gas price predictions in their 2020-21 annual report...

|

| p28, 2020-21 report |

... and the updated prices and predictions in the 2021-22 report:

|

| p31, 2021-22 report |

The main takeaway of these two charts is that the gas market is volatile enough that a 5-year price forecast jumped by what looks like 70% in just a 12 month period. For more on predictions, read Nassim Taleb.

Currently, prices are at 10-year highs, according to this Government of Alberta site.

Risks to SaskEnergy affecting natural gas prices (and costs to ratepayers)

These are SaskEnergy-identifed risks (p41) from the 2021-22 report with colour commentary by me:

- Government Climate Policy: "the most significant risk facing SaskEnergy." More regulation equals more compliance costs (note that I am not taking a stance, I'm just telling it like it is). Regulations bite SaskEnergy in two ways: direct costs of complying with regulations, and indirect costs of lost revenue due to customers complying with regulations (example: homes and industry reducing their carbon footprint by using less gas).

This amplifies risks of aging infrastructure serving a very geographically dilute population: less revenue to maintain the same assets to the reliable service level we currently expect. - Interest Groups: essentially, NIMBYism. "Customers want a high level of service" - we all want our furnace in winter and our BBQ in summer - "but many do not want the associated infrastructure nearby, or through, their land."

"As a fossil fuel provider [...] SaskEnergy faces additional challenges due to growing opposition [...] with respect to the development of further fossil fuel infrastructure."

It gets harder every year to build infrastructure in any industry. One above NIMBY: BANANA = Build Absolutely Nothing, Anywhere Near Anyone. - Public Acceptance: "While the acceptability of natural gas use presently remains high in the local market, there is potential for a shift to occur with either a direct or indirect impact on SaskEnergy."

Absolutely! If Saskatchewan deployed a fleet of nuclear reactors we could decarbonize our electricity sector and potentially begin transitioning building heating from fossil gas to electric heat. - Natural Gas Prices: SaskEnergy states "prices can change significantly, and often do over a short period of time," but (in this section) they don't draw a direct link to what we discussed above: declining provincial oil production (hence: less local natural gas production), Saskatchewan's dependency on Alberta gas for heating and power generation, and growing LNG demand globally coupled with Canadian LNG export ambitions that link the Prairies to the global gas market - and its pricing volatility.

Get to the point already!

Referring back to my other energy posts: Saskatchewan has committed to increasing Variable Renewable Energy (VRE) sources for electricity and is phasing out coal power plants by 2030.

While some Manitoba import hydro capacity is planned, coal will largely be replaced with gas by 2030 (the Small Modular Reactor being commissioned "as early as" 2034) and VRE projects will be largely be backed up by more natural gas generation.

So the formula is:

+ increasing SK deployment of Variable Renewable Energy sources

+ increasing SK gas demand for VRE backup and coal replacement

+ decreasing SK local natural gas production

+ increasing regulatory compliance costs

+ increasing dependency on Alberta gas

+ increasing Canadian exposure/coupling to global gas markets

+ increasing global gas demand (as a so-called transitory fuel)

= higher gas and electricity prices for SK ratepayers (because most of our electricity will come from gas).

Possible solutions/mitigations?

Contract every possible megawatt of hydro power from Manitoba for as long as feasible, for cost, carbon, and dispatchability. Push the SMR Roadmap forward. Increase diversity and independence in our electrical energy supply: build out a fleet of SMRs where 2 years' worth of super energy-dense fuel can be bought and stockpiled on site (compare to gas which is delivered just-in-time from a pipe at today's market prices).

As always: open to constructive feedback and corrections!